The eco-social tax reform has been in force in Austria since March 1st, 2022 and has clarified crypto taxation in Austria. The special feature: Taxpayers can opt to be taxed according to the new tax rules from January 1st, 2022. In this article, you will find out when it is worthwhile and how to go about it.

The most important changes in crypto taxation from March 1st, 2022

- The special tax rate of 27.5% applies to most crypto transactions.

- Crypto assets are only taxed when they are exchanged for FIAT (the crypto to crypto exchange is tax-free, the acquisition costs are carried forward & stable coins are considered crypto) and

- Profits and losses from trading in cryptocurrencies can be offset against profits and losses from capital market transactions (e.g. shares).

What does it mean to opt into the new tax rules early?

From January 1st, 2022, crypto taxpayers in Austria can opt to be taxed according to the new crypto tax rules of the eco-social tax reform. In principle, taxation will come into effect on March 1, 2022.

The rule is: all or nothing. Anyone who opts for the new tax regime early, does so for the entire period from January 1st, 2022 to February 28th, 2022.

For whom does it make sense to opt into the tax reform early?

Good question! The short answer: for those expecting an income tax rate above 27.5%. The reason for this:

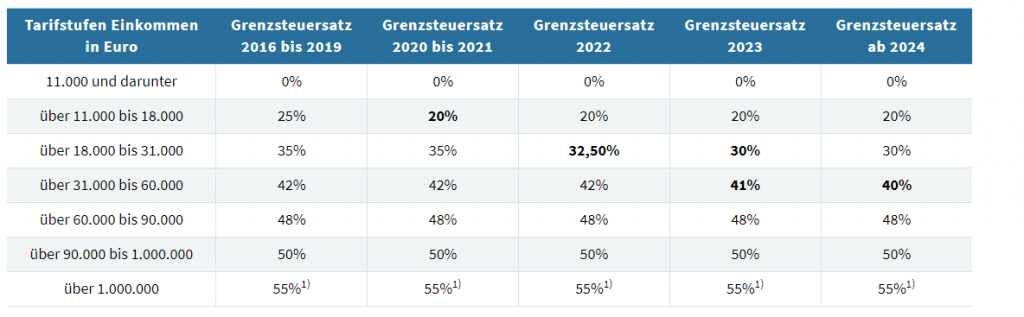

- With the tax reform, the special tax rate (27.5%) replaces the income tax rate (up to 55%) for most crypto transactions.

- The income tax rate is progressive and depends on total income.

In 2022, this means that income up to €11,000 will not be subject to income tax. Income from €11,000 to €18,000 is taxed at 20%, income from €18,000 to €31,000 at 32.5%, etc. This results in a mixed tax rate. If the mixed tax rate is higher than the special tax rate, it makes sense to opt in early because the lower special tax rate of 27.5% will be applied for January and February 2022 as well.

What else should I consider?

If you opt into the new regulations early on, you are opting for the entire period.

What forms do I need for my crypto tax return in Austria 2022?

In Austria, you submit your crypto tax return with your income tax return. The forms to use are:

E1 (income tax return) and

E1kv (supplement to income tax return E1 for income from capital assets).

You can find the forms at Service.bmf, alternatively, enter your information directly in Finanzonline.

How do I opt into the new regulation early?

The option (§ 124b Z 385 lit. c EStG 1988) (intended: § 124b Z 384 lit. c EStG 1988) to be taxed early according to the regulations of the tax reform from January 1st, 2022 is done by application. This application is implicit and results from the fact that you also enter taxable profits from realized increases in value in the period from January 1st, 2022 to February 28th, 2022 in code numbers 173/174 in the E1kv form.

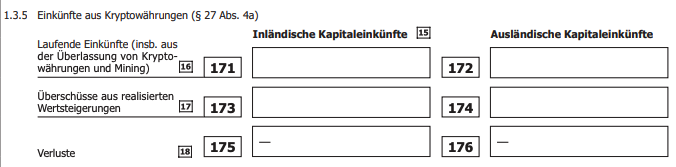

In the form E1kv you enter under 1.3.5. Income from cryptocurrencies (§ 27 Para. 4a EStG 1988).

In codes 173 and 174 you enter the domestic and foreign taxable realizations of cryptocurrencies.

This means: if you enter taxable profits that were made between January 1st, 2022 and February 28th, 2022 through trading in cryptocurrencies in codes 173 and 174, you are automatically submitting an application to opt into the new regulation early.

In other words: if you want to opt for the new taxation from January 1st, 2022, enter all your profits from the sale of cryptocurrencies in codes 173 and 174.

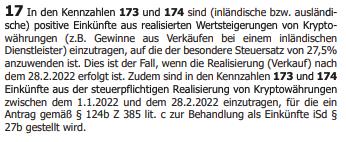

For clarification, the fact that taxable gains between January 1, 2022 and February 28, 2022 are also covered is indicated in statement 17.

“Income from taxable realizations of cryptocurrencies between January 1st, 2022 and February 28th, 2022 must also be entered in code numbers 173 and 174, for which an application pursuant to § 124b Z 285 lit. c (intended: § 124b Z 384 lit c) EStG 1988 for treatment as income within the meaning of § 27b.”

Note: As of February 5th, 2023, we are aware that opting for this option early applies to realized increases in value from cryptocurrencies. In other words, trading. We have inquired about this with the Ministry of Finance. As soon as this information is available, we will publish an updated version of this article.

How do I not opt into the new regulation early?

In case you do not want to opt into the new legal situation as of January 1, 2022, the following applies: declaration and explanation of gains as per the old legal situation.

Trading profits before February 28, 2022 are to be entered as speculative transactions in code 801 in Form E1.

What does this mean for staking income, for example? According to the old legal situation – in most cases, depending on the underlying protocol – these assets are recorded with their market value at the time of inflow as other income within the meaning of Section 29 Z 3 EStG 1988. These are to be entered in form E1 under code 803.

What tax rules apply to assets purchased before February 28th, 2021?

In the case of cryptocurrency purchased on or before February 28th, 2021, tax-free withdrawals are possible after a one-year retention period. In the event of early withdrawal, taxation is based on the income tax rate (see table above).

Transitional regulation according to § 124 b Z 384 lit b EStG 1988:

Old assets (purchased before February 28th, 2021) that are used to generate current income remain unaffected.

The following applies to lending, mining, staking, bounty, hard fork and airdrops in connection with old assets: If the assets (old assets) acquired before February 28, 2021 are used to generate current income after February 28, 2022, the cryptocurrencies acquired are deemed to have been used after February 28, 2022 .2021 acquired (new assets). The old assets remain unaffected, even if they are used for current income.

In short

- The tax reform for the taxation of cryptocurrencies

in Austria applies from March 1st, 2022. - Taxpayers can opt into the new regulation early by applying from January 1st, 2022.

- Opting in is only possible for the entire period 1/1/2022 – 2/28/2022.

- The application is considered implicit if taxable profits are entered in codes 173 and 174 of the E1kv form, which relate to the period 1/1/2022 – 2/28/2022.